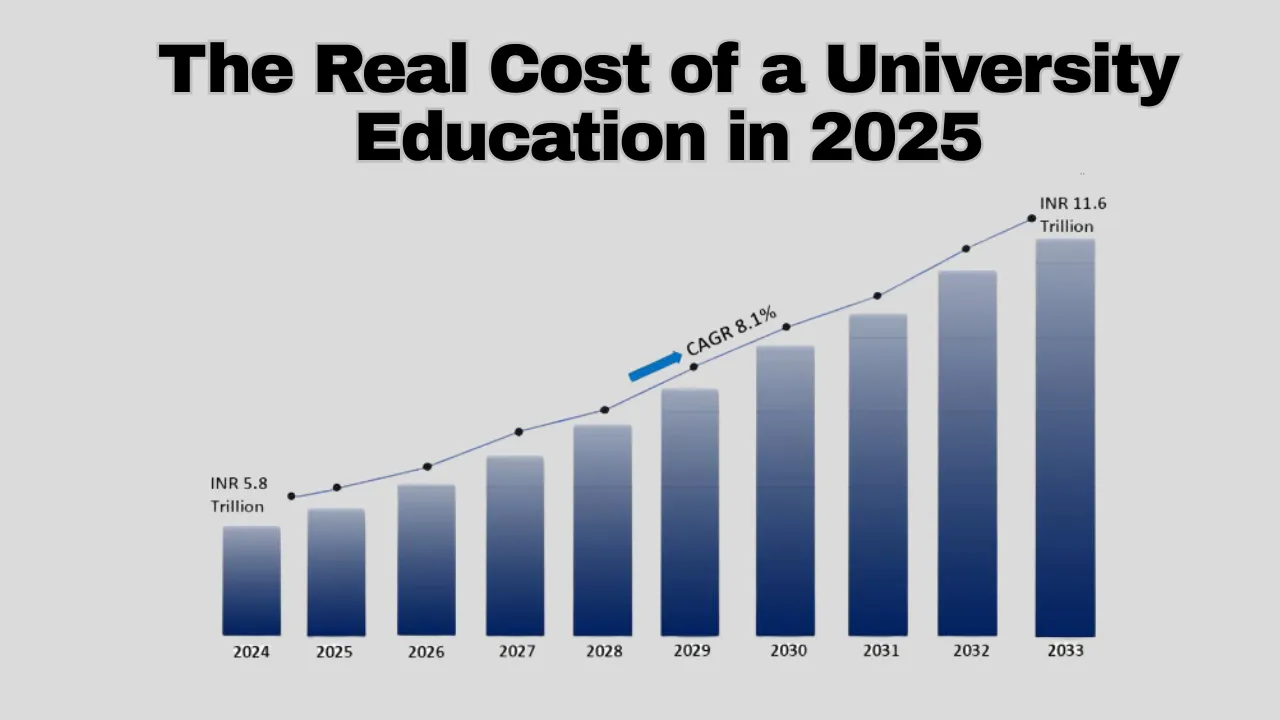

The cost of a university education in 2025: The cost of a university education in 2025 is a growing concern for students and parents across the globe. As tuition fees, housing, and everyday expenses continue to rise, the dream of higher education is becoming harder to afford. With the added impact of inflation and evolving learning models, understanding the full picture of college expenses is more important than ever.

This article breaks down the actual cost of a university education in 2025, including tuition, accommodation, technology, and hidden costs. We’ll also discuss financial aid, budgeting tips, and how students can make smart choices to reduce their debt after graduation. Whether you’re planning to study locally or abroad, this guide offers a clear look at what you can expect.

Rising Tuition Fees

Tuition fees remain the largest part of the cost of a university education in 2025. Most universities have increased their tuition to keep up with operational costs, faculty salaries, and upgraded technology. In the US, for example, average tuition for public universities has reached around $11,000 per year for in-state students and over $28,000 for out-of-state students. Private institutions charge significantly more, often crossing the $40,000 mark annually.

International students face even higher fees, which makes financial planning essential. Many universities justify this increase with improved facilities and digital learning platforms, but it still places a heavy burden on students and families.

Hidden Academic Costs

While tuition is the most visible expense, there are several hidden academic costs that contribute to the cost of a university education in 2025. These include textbooks, lab fees, course materials, printing, and software subscriptions. On average, students can expect to spend $1,200 to $1,500 per year on these essentials.

Technology has become a necessary tool for learning, with most courses requiring laptops, tablets, or access to premium educational platforms. These tech-related expenses can add several thousand dollars over a student’s academic journey.

Accommodation and Living Expenses

Living costs are a major part of the cost of a university education in 2025, especially for students who live away from home. Dorm fees, off-campus rent, groceries, and transportation vary by region, but the average annual cost ranges from $12,000 to $20,000.

Urban campuses in cities like New York, London, or Sydney can push these figures even higher. Students also need to consider utilities, internet, and everyday items such as clothing and hygiene products, which can easily add up over time.

Financial Aid and Scholarships

Thankfully, there are many ways to reduce the cost of a university education in 2025 through financial aid and scholarships. Most universities offer need-based and merit-based aid. In the US, FAFSA continues to be a critical tool for federal and state aid, while countries like Canada, Australia, and the UK have their own systems.

Scholarships can be highly competitive but can cover full or partial tuition and living expenses. Students are encouraged to apply early and look beyond their university—private organizations, nonprofits, and corporations also offer financial assistance.

Student Loans and Long-Term Debt

Many students turn to loans to manage the cost of a university education in 2025. While loans can open doors, they also lead to long-term debt. In the US, the average student loan debt is now over $38,000. Loan repayment terms vary, but interest rates and payment timelines can cause financial stress after graduation.

Government loan forgiveness programs and income-based repayment plans offer some relief, but students should borrow only what they truly need. Financial literacy and careful budgeting are essential to avoid heavy debt burdens in the future.

Part-Time Jobs and Income Support

A smart way to handle the cost of a university education in 2025 is to work part-time during studies. On-campus jobs, internships, and freelance gigs allow students to earn while they learn. Many universities have work-study programs that align with academic schedules, making it easier to manage both responsibilities.

Some students also turn to remote work opportunities, including tutoring, writing, or digital marketing. These roles not only help financially but also add to a student’s resume, improving their employment chances after graduation.

Online vs. On-Campus Education Costs

The growth of online education has changed how students evaluate the cost of a university education in 2025. Online degrees often cost less than traditional campus programs. Students save on housing, transport, and even course materials.

However, online students may miss out on in-person networking, lab experiences, and campus life. It’s important to compare the full value of online vs. on-campus education, not just the cost. Hybrid models are also gaining popularity, offering a balance between affordability and experience.

Budgeting Tips for Students

- Track spending: Use budgeting apps to monitor daily expenses and avoid overspending.

- Cook at home: Limit takeout and learn basic meals to save money on food.

- Buy used books: Rent or buy second-hand textbooks instead of new ones.

- Use student discounts: Take advantage of discounts on software, entertainment, and travel.

- Apply for aid yearly: Reapply for financial aid every academic year to ensure continued support.

5 Major Costs to Prepare For

1. Tuition Fees:

The biggest expense, especially at private or international universities.

2. Housing and Food:

Dorms or rent, plus groceries, utilities, and dining.

3. Textbooks and Supplies:

Books, lab gear, laptops, and other academic tools.

4. Travel and Transport:

Daily commutes, long-distance travel, and study-abroad expenses.

5. Health Insurance and Fees:

Mandatory coverage in many universities, often not included in tuition.

FAQs

How much does a university degree really cost in 2025?

On average, total yearly costs range from $25,000 to $60,000 depending on location, university type, and living choices.

Are online degrees cheaper than traditional ones?

Yes, online degrees can be more affordable due to lower tuition and no housing costs.

Can scholarships cover full expenses?

Some scholarships do, especially from top universities or private sponsors, but most are partial.

Do public universities cost less than private ones?

Generally, yes. Public institutions often have lower tuition, especially for local students.

How can students reduce their university expenses?

By budgeting, applying for aid, working part-time, and choosing cost-effective study options.

Final Thought

The cost of a university education in 2025 is high, but with the right planning, financial aid, and smart decisions, it’s still possible to make it affordable. Understanding the true expenses helps students and families prepare better and avoid financial strain in the future. Don’t let cost stop you from chasing your dreams—explore options, apply for help, and manage your budget wisely.

If this article helped you, share it with your friends or leave a comment below. Want to know how your career path aligns with your spending habits? Explore your student finance horoscope now!